Housing Taxes

Summary

- Players who have two or more "qualifying" houses across all of their accounts (by OutlandsID) will now be subject to paying Housing Taxes

- This system will go into effect on April 15, 2025

- Players will not accumulate any taxes until the system goes into effect

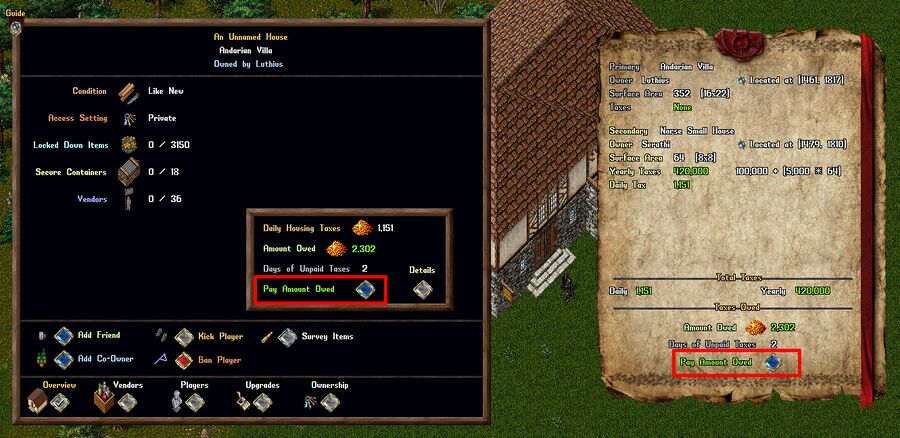

Housing Tax Menus

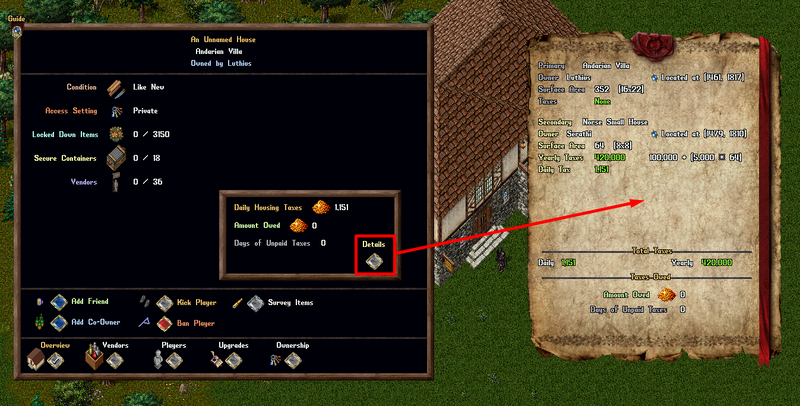

- If a player either currently qualifies for Housing Taxes, or has past unpaid Housing Taxes, they will see a Housing Taxes section displayed in the center of the Overview Page of the Housing Menu of their houses

- Players can click the "Details" button on the Housing Tax section to view a Tax Report menu explaining their Housing Taxes in detail

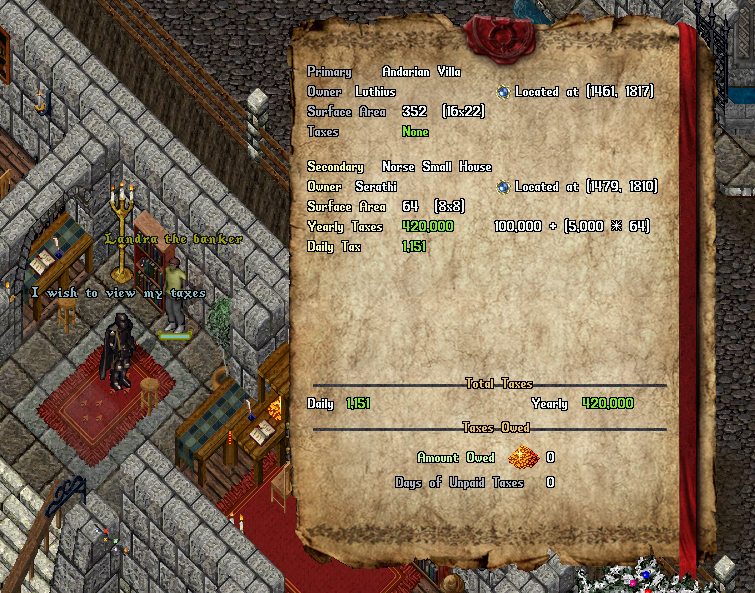

Bankers

- Any player can also say the word "Tax" near a Banker NPC in town to view a Tax Report for their houses on their accounts (by OutlandsID)

- Players can also shift-click a Banker and select the Housing Taxes context menu entry to view their Tax Report

Qualifying and Exempt Houses

By default, all types of Houses and House Boats are considered to be qualifying houses. However, the following types of houses are considered exempt types:

- Prestige Guild Houses

- Rental Rooms

Exempt House types will never be subject to taxes and will have no impact on Housing Taxes for a player

Who Qualifies For Housing Taxes

- Only players who have two or more "qualifying" houses across their accounts (by OutlandsID) will be subject to Housing Taxes

- Players who only have a single house will never be subject to Housing Taxes

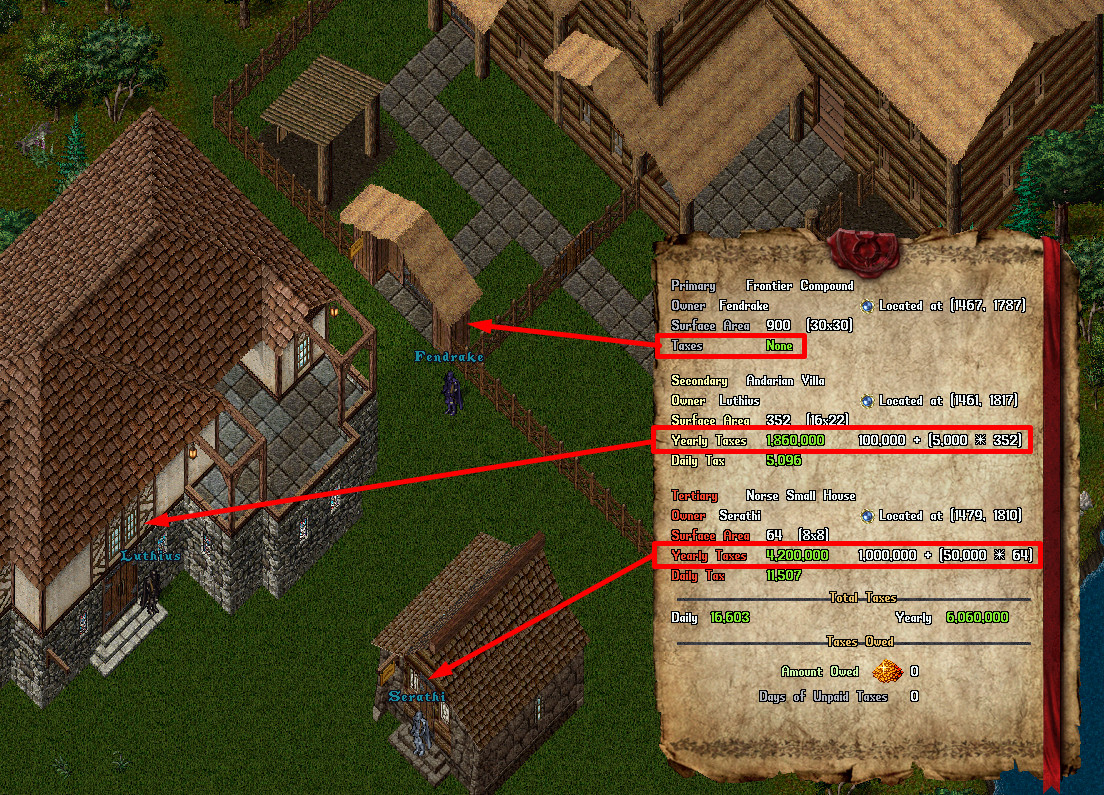

Surface Area

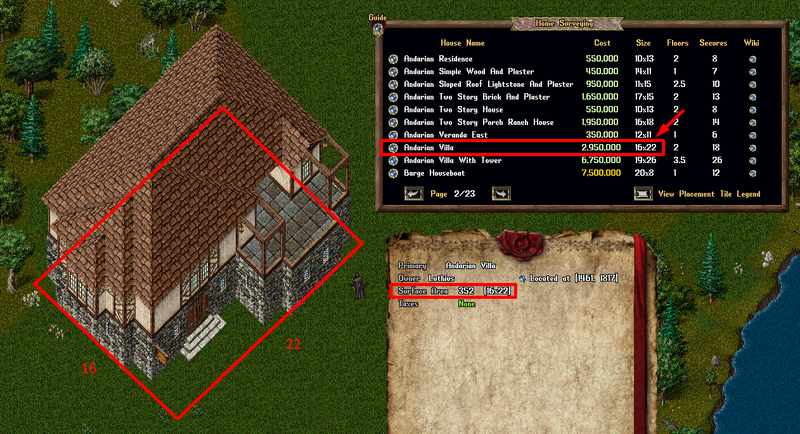

- In order to determine Housing Tax amounts due for players, their qualifying houses are "ranked" in order of highest to lowest by Surface Area

- The Surface Area of a house is based on the Dimensions of the ground floor, i.e (Width * Height)

Example: A house that was listed as 16x22 would have a Surface Area of 16 x 22 = 352 Tiles

Players can find the Dimensions of a house in the following locations:

- In the Home Surveying Tool menu

- In the Housing Taxes Menu

- In the Outlands Wiki for Housing

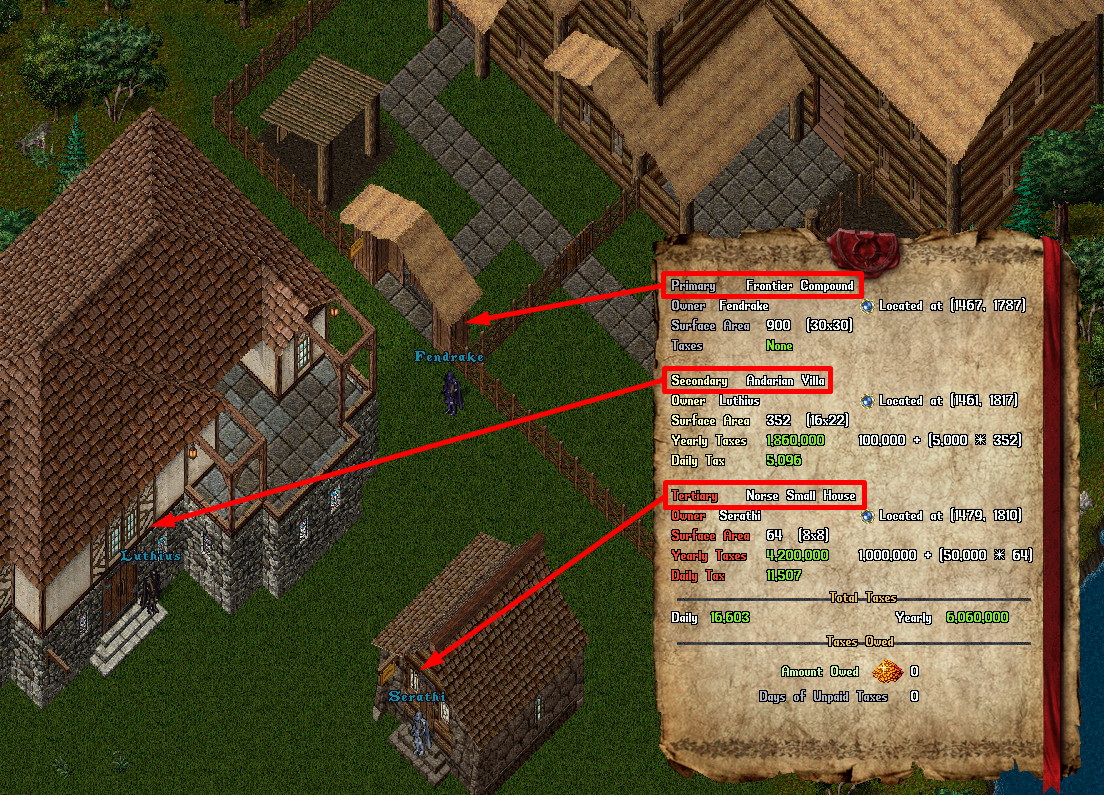

Ranking Houses

- Exempt House types (Rental Rooms and Prestige Guild Houses) are never ranked and will never impact Housing Taxes for players

- A player's qualifying house with the 1st largest Surface Area is considered their Primary House

- A player's qualifying house with the 2nd largest Surface Area is considered their Secondary House

- A player's qualifying house with the 3rd largest Surface Area is considered their Tertiary House

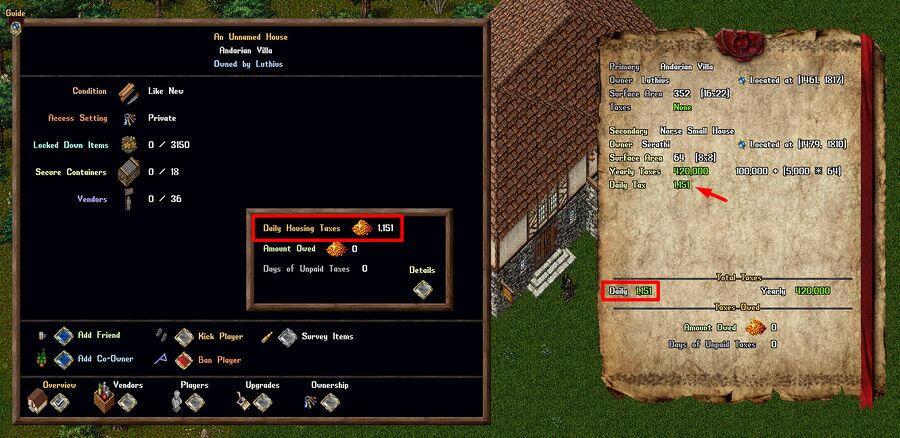

Yearly Tax Amounts

The amount of Yearly Taxes that are accumulated for each of a player's houses is based on their Ranking, as follows:

| House | Yearly Tax |

|---|---|

| Primary | None |

| Secondary | (100,000 + (5,000 * Surface Area)) Gold |

| Tertiary | (1,000,000 + (50,000 * Surface Area)) Gold |

Accumulating Taxes

- Taxes for houses are accumulated on a Daily basis

- The Daily Tax amount for each house is (Yearly Taxes / 365)

- At the start of each day, players accumulate the total combined Daily Tax amounts for all qualifying houses across their accounts (by OutlandsID)

Note: While Yearly Taxes are listed in the Tax Report, that value is only used to calculate Daily Taxes (i.e there is no end of year "massive" tax for houses)

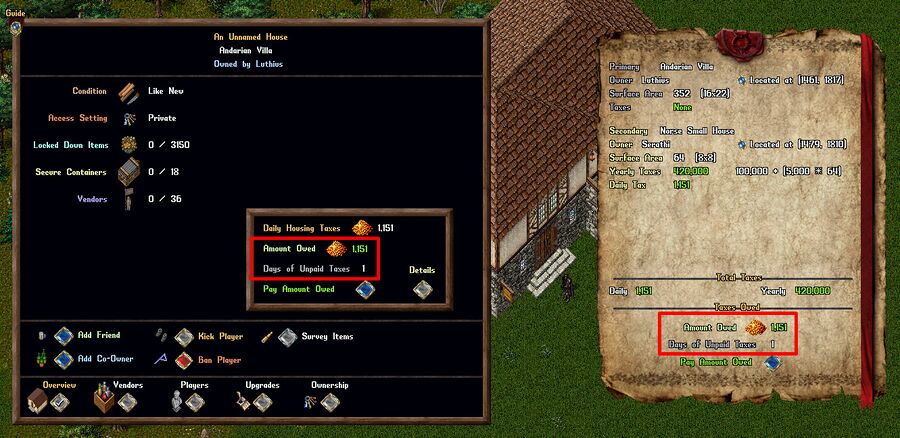

- Players can view their "Amount Owed" from either the Housing Menu or a Tax Report menu

- Players can also view how many "Days of Unpaid Taxes" they have accumulated since last paying off their Amount Owed

Paying Taxes

- Players can pay their Amount Owed at any time they wish (does not have to be daily)

- To do so, any character on their OutlandsID can click the "Pay Amount Owed" button on either the Housing Menu or Tax Report menu to pay the total amount in Gold from their bank balance

- Doing so will reset the both Amount Owed and Days of Unpaid Taxes to 0

Autopay Taxes

- The Autopay Taxes setting can be enabled/disabled to automatically pay the Amount Owed at the start of each day

- By default Autopay Taxes is Enabled for players

- Gold used to make automatic payments will be taken from the highest Bank Balance of any character on that OutlandsID, and any remaining gold needed will be taken from other character's banks on that OutlandsID in order from highest to lowest Bank Balance

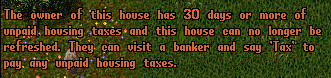

Excessive Unpaid Taxes

- If a player accumulates 30 Days of Unpaid Taxes or more they will be subject to Excessive Unpaid Taxes restrictions

- The "Days of Unpaid Taxes" will display in red text if Excessive Unpaid Taxes restrictions are in place

Players with Excessive Unpaid Taxes have the following applied:

- All houses owned by the player (across their OutlandsID) cannot be Refreshed by anyone (even themselves)

- The player cannot place new houses

- The player cannot take control of existing houses (transfer / trade / purchase / lottery)

Warning Alerts

- Players with Excessive Unpaid Taxes will receive an overhead warning and sound effect each time they log in or attempt to refresh their houses

- When Co-Owners and Friends of their houses attempt to refresh them, they will receive a system message and sound effect informing them the owner currently has Excessive Unpaid Taxes and refreshing the house is no longer possible

Daily Taxes when Transferring Houses

- If a player purchases, transfers, or sells one or more qualifying houses during the day, they will still accumulate taxes at the start of the next day based on whatever their highest Daily Tax amount was at any point during that day (but will future days will be assessed as normal)

- This is intended to prevent players from shuffling expensive houses to other players at the end of the day to avoid paying taxes on them